Steve Loftus is a businessman and utility industry analyst.

The financial security of future generations in the United Kingdom faces a grave threat that few politicians dare to address: our unsustainable state pension system.

For decades, governments have prioritized electoral success over fiscal responsibility, creating a ticking time bomb that threatens to explode in our children’s faces. A close examination of the data reveals both the scale of this brewing crisis – and points toward a conservative approach that could chart a more sustainable course for Britain’s economic future.

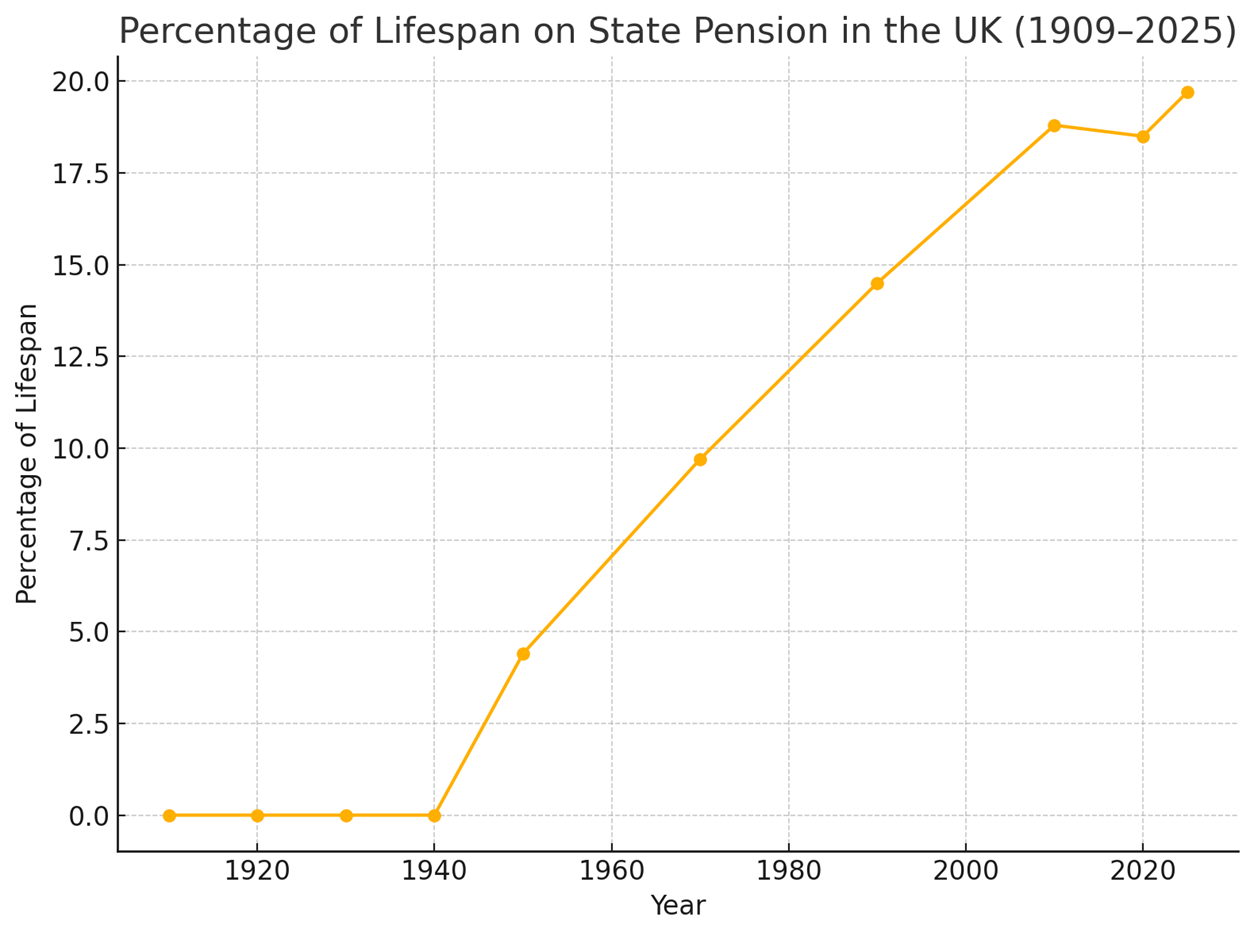

When the state pension was introduced in 1909, few Britons lived long enough to claim it. Even by 1950, the average person spent just a small fraction of their life in retirement.

Fast forward to today, and the picture has dramatically changed: Britons now spend nearly 20 per cent of their lives above the state pension age, a percentage that continues to grow as life expectancy increases.

Had the state pension age simply kept pace with life expectancy trends since 1980, it would currently be 73. To maintain the same proportion of life spent in retirement as in 1990, the pension age would need to rise to a staggering 77 by 2040.

The Office for Budget Responsibility projects that state spending on pensioner benefits will balloon from 6 per cent to 10 per cent of national income over the next 45 years – equivalent to an additional £100 billion annually in today’s terms.

This burden falls squarely on the shoulders of younger generations, who face punishing taxation to fund a system they may never benefit from themselves. Our current pay-as-you-go model, where today’s workers fund today’s retirees, was designed for a different demographic reality – one with many workers and few pensioners.

As our population ages and birthrates decline, this model becomes mathematically impossible to sustain. The International Longevity Centre warns that without reform, the state pension age may need to rise to 71 by 2050 just to remain affordable.

Yet political cowardice prevails. Governments, terrified of alienating older voters, cling to expensive policies like the triple lock (guaranteeing that the state pension rises annually by the highest of inflation, earnings growth, or 2.5 per cent) despite its catastrophic long-term impact on public finances.

Even Rachel Reeves has capitulated, pledging to maintain this fiscally irresponsible policy until the end of this parliament.

As conservatives, we should be appalled by a system that fosters dependence on the state, undermines personal responsibility, and imposes an immoral debt burden on future generations. This is precisely the kind of big-government overreach – promising benefits it cannot deliver and leaving our children to suffer the consequences – we have always opposed

Rather than merely lamenting this crisis, we should consider a possible transformative approach: the creation of a fully funded, ring-fenced “Great Britain Pension Fund” (GBPF). This concept embodies conservative principles of investment, individual empowerment, and sustainable governance while offering a practical path forward.

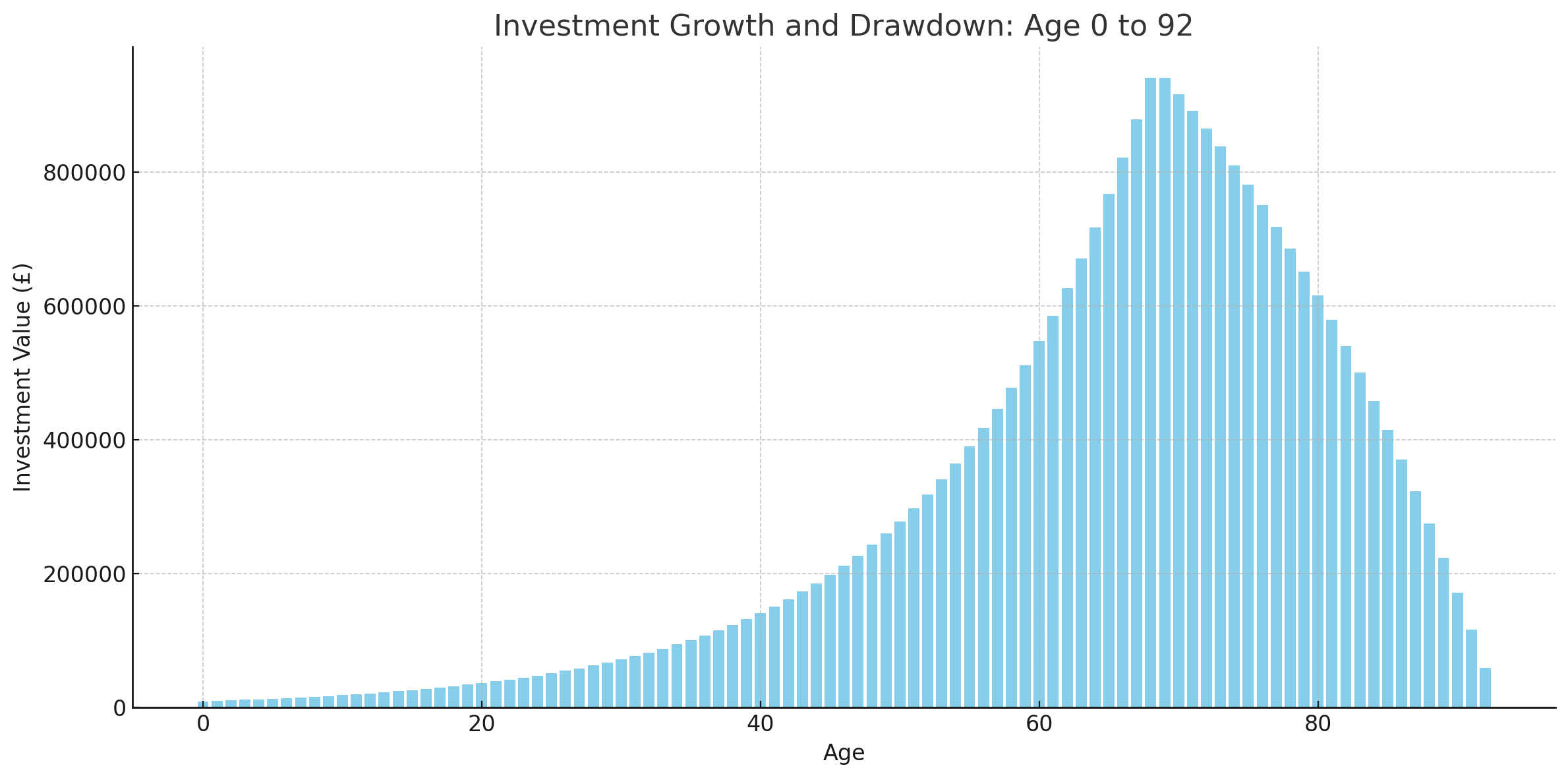

The concept is elegantly simple: for every child born in the UK, the government would invest £9,500 into the GBPF. This fund would be invested in a diversified portfolio targeting an annual return of seven per cent – a conservative estimate, given historical returns of ten per cent in American markets and six per cent in British ones.

Over 68 years, that initial investment would grow to approximately £940,000 – sufficient to fund that individual’s pension until age 92. As retirement approaches, a portion of the fund would shift to safer investments yielding a stable four per cent return, ensuring income security in old age.

This model acknowledges real-world variables. Around 13 per cent of people don’t reach age 65, and only 15 per cent make it to 92, providing significant buffer for those who live longer or periods of lower returns.

The system would also replace unfunded public sector pension liabilities, addressing another looming fiscal crisis. If the fund generates surplus returns, these could enhance benefits or even lower the retirement age in the future.

The financial case is compelling. With approximately 650,000 children born annually in the UK, the initial cost would be less than £6bn per year – a fraction of the projected £100bn annual increase in pension spending by 2070. Every pound invested now saves thirty pounds in future liabilities.

This is the epitome of conservative fiscal responsibility: making strategic investments today to prevent catastrophic expenditure tomorrow.

The GBPF offers benefits far beyond securing pensions: it creates an opportunity to revolutionize Britain’s approach to national investment and ownership. This massive fund could finance crucial infrastructure projects that enhance national productivity and prosperity, such as nuclear power stations, high-speed rail, schools, and hospitals.

Instead of relying on foreign pension funds to own critical national assets like our water system, the GBPF could take ownership, ensuring profits benefit British retirees rather than overseas investors. This approach strengthens national sovereignty and economic independence – core conservative values – while reducing our dependence on foreign capital.

Perhaps most importantly, the GBPF would give citizens a tangible stake in the nation’s economic future. Unlike the current system, where contributions disappear into general taxation with no clear connection to future benefits, the GBPF creates a direct link between national economic growth and retirement security. When Britain prospers, so do its future pensioners.

This alignment of interests encourages a long-term perspective on economic policy and national development, moving beyond the short-termism that has plagued British governance for generations.

The greatest challenge in implementing the GBPF lies in finding the initial funding while continuing to meet current pension obligations. Today’s tax revenues are already committed to paying current pensions, making it difficult to divert funds into a new system.

However, this is fundamentally a question of priorities rather than affordability.

The annual cost of £6bn to fund the GBPF is remarkably modest when compared to other government expenditures. We currently allocate £30bn to carbon capture schemes, £13bn (and rising) to renewables subsidies, and £11bn to foreign climate aid.

A fraction of these funds could launch a program that would permanently solve our pension crisis while creating a sovereign wealth fund to benefit generations of Britons.

Yes, the transition would require a reallocation of resources. But the cost of inaction vastly exceeds the cost of reform. Without change, the pension system will inevitably collapse under demographic pressures, leaving future generations with nothing. Meaningful reform demands that we make difficult choices today to avert catastrophe tomorrow.

The pension crisis represents a defining test of conservative resolve. For too long, politicians across the spectrum have chosen comfortable lies over uncomfortable truths, pursuing short-term popularity at the expense of long-term stability.

The Great Britain Pension Fund offers an alternative path: one that reduces state dependency, empowers individuals, secures Britain’s financial future, and creates a new model of national investment and ownership. It embodies the best of conservative thinking: fiscal responsibility, long-term planning, and a genuine commitment to future generations.

The time for half-measures and political cowardice has passed. We conservatives must lead this national conversation with clarity and courage. By championing the Great Britain Pension Fund, we can transform a looming disaster into an unprecedented opportunity for growth, ownership, and prosperity. The future of our children – and our nation – depends on it.

![Jasmine Crockett Justifies Mass Illegal Immigration With Bizarre Argument [WATCH]](https://www.right2024.com/wp-content/uploads/2025/03/1742007023_Jasmine-Crockett-Justifies-Mass-Illegal-Immigration-With-Bizarre-Argument-WATCH-350x250.jpg)

![Red Sox Fan Makes the ‘Catch of the Day’ with Unconventional ‘Glove’ [WATCH]](https://www.right2024.com/wp-content/uploads/2025/04/Red-Sox-Fan-Makes-the-‘Catch-of-the-Day-with-350x250.jpg)

![NYC Tourist Helicopter Falls into Hudson River, Siemens Executive and Family Among Those Killed [WATCH]](https://www.right2024.com/wp-content/uploads/2025/04/NYC-Tourist-Helicopter-Falls-into-Hudson-River-Siemens-Executive-and-350x250.jpg)